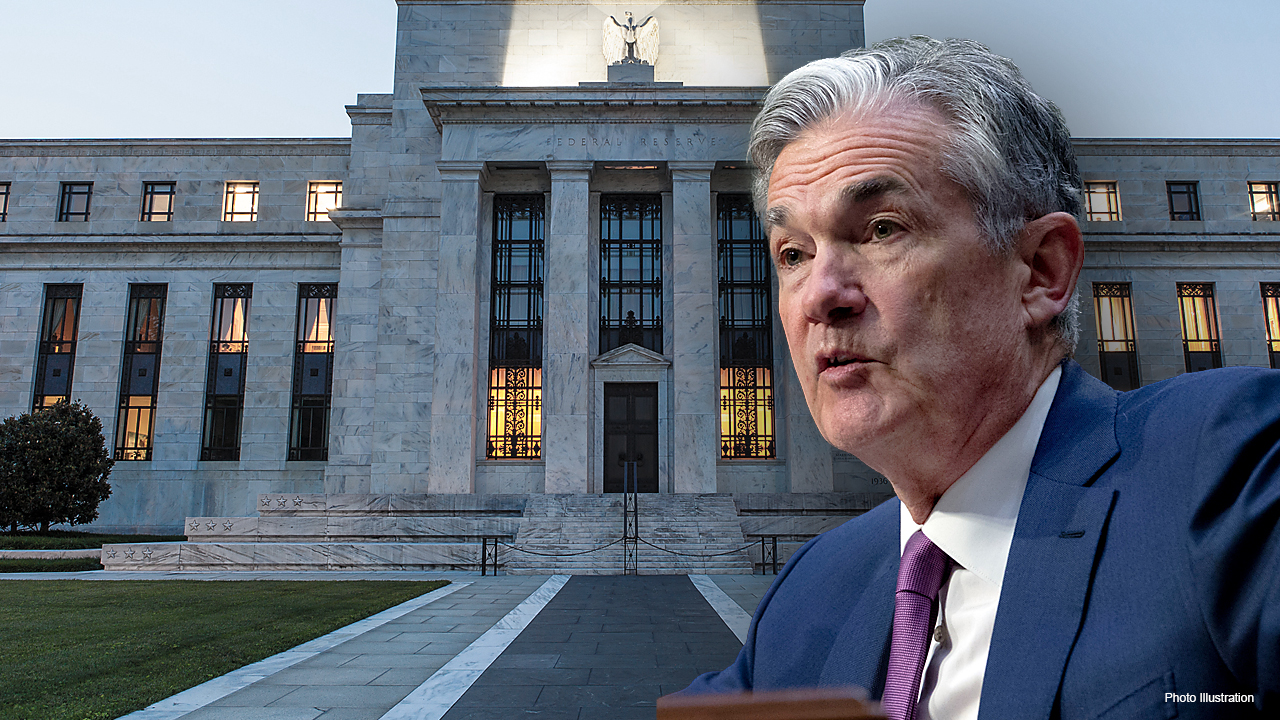

US dollar falls to three-year low and gold hits $3,500 after Trump intensifies attack on Fed chair Powell – business live

Rolling coverage of the latest economic and financial news

Worried investors are continuing to pile into gold, pushing it up to fresh record highs today.

Gold hit $3,500 per ounce for the first time this morning, extending a monster rally that has pushed bullion up from $2,623/ounce at the start of this year.

The tariff tug-of-war still has no end in sight, and now the Powell power struggle is adding more fuel to the fire, with whispers from the White House about his potential ousting rattling already jittery investors. At this rate, even bad news might be seen as a buying signal - if only because something, anything, from Washington might offer a sliver of direction.

Markets are now itching for real progress on trade deals - posts from the President on Truth Social or X just aren’t cutting the mustard anymore. Investors want ink on paper, not just words, as a clear signal that movement is happening - and the clock is ticking.

The US imported $12.9 billion in solar equipment last year from the four countries that would be subject to the new duties, according to BloombergNEF. That represents about 77% of total module imports.

Companies not named in Vietnam face duties of as much as 395.9% with Thailand set at 375.2%. Country-wide rates for Malaysia were posted at 34.4%. Continue reading...

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0