UK house price growth ‘surprisingly’ hits two-year high; dollar rises after Trump’s Brics tariff threat – business live

Annual house price inflation rises to 3.7%, the fastest since November 2022, Nationwide reports

Here’s some reaction to this morning’s Nationwide house price report:

Guy Gittins, CEO of Foxtons:

“After the rate of house price growth slowed in the lead up to the Autumn Budget, the latest figures suggest the market is once again starting to accelerate.

This consistent positivity demonstrates the current strength of the market despite the complications posed by wider economic headwinds. Over the last 12 months we’ve seen a huge increase in new buyer volumes, viewings and offers made and there is a very healthy level of stock currently on the market. So, whilst house prices are climbing, there is certainly a good level of stock for buyers to choose from and the market isn’t overheating due to the usual supply and demand imbalance.

“November’s property market saw an increasing number of first-time buyers who were and still are motivated to purchase a property before the stamp duty changes in April 2025. This, in addition to high demand from house hunters in general, led to more sales being finalised than in November of last year.

With the current level of buyer activity expected to continue well into the new year, we predict London properties to hold their value or see a gradual value increase of up to 3% over the course of next year.”

“Another month of house price growth further indicates the level of confidence in the market which has been evident since the reduction and stability in both mortgage rates and inflation.

“Both sellers and buyers are pushing to transact, as affordability is improving.

“In our offices we are seeing prices hardening and stock levels rising, partly because the Budget, though not particularly helpful, was not as bad as many feared either.

“As a result, some pent-up demand was released and buyers are digging a little deeper. That extra choice, as well as broad acceptance that inflation and mortgage rates will not reduce as far and as fast as many expected, has meant caution still prevails. Transaction lengths are extending too, particularly bearing in mind the seasonal distractions so sellers still need to be extra competitive to attract serious attention at this time of year.”

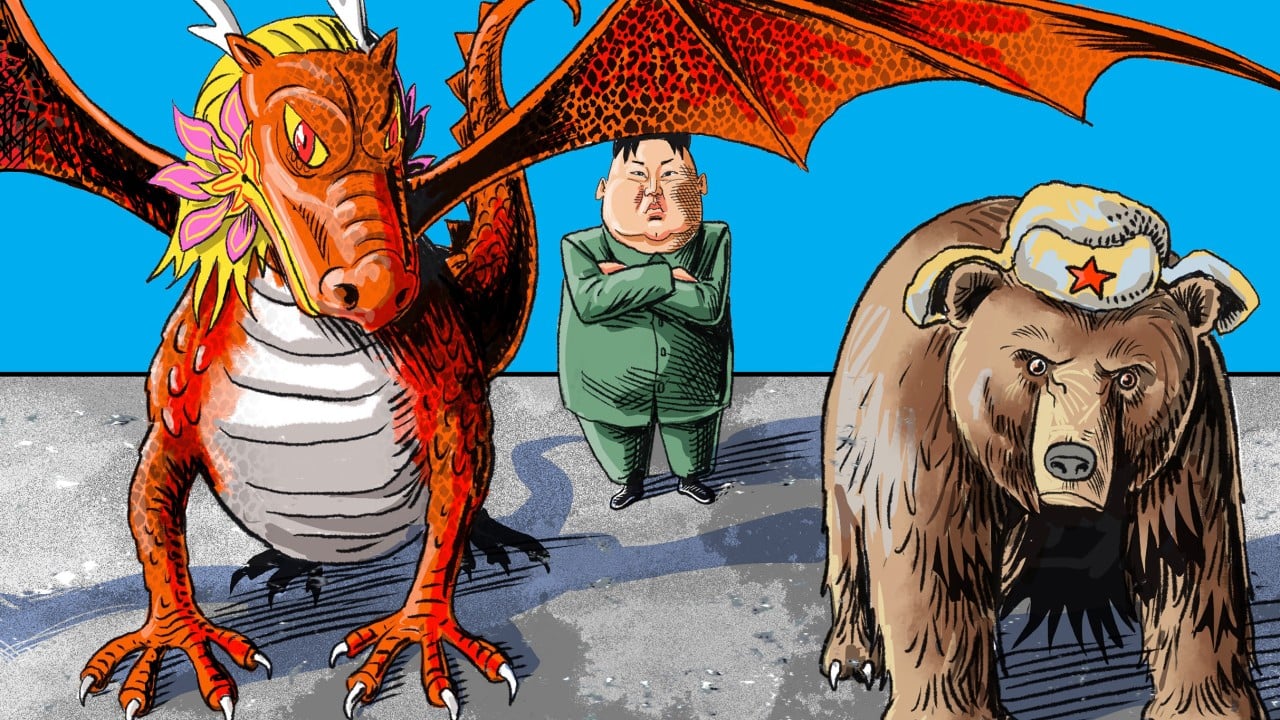

We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy. Continue reading...

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0