Nissan-Honda $60bn merger ‘basically over’, reports claim; UK interest rate cut expected – business live

Rolling coverage of the latest economic and financial newsBank of England poised to cut interest rates amid UK economic gloomThe $60bn merger between Nissan and Honda to create the world’s third-largest carmaker looks on the brink of collapse this morning.According to reports from Japan, Nissan CEO Makoto Uchida met with Honda CEO Toshihiro Mibe today, and explained that he wishes to terminate their merger discussions.Nissan’s board is in favour of abandoning merger talks with Honda, although calling them off has yet to be decided by executives at the two Japanese carmakers, a source close to the matter told AFP on Thursday.“The latest conditions put on the table by Honda are unacceptable for Nissan... It needs to be formalised, but basically, it’s over,” the source said.Looking ahead, we see room for deeper cuts than what financial markets expect. Trade uncertainty is rising, labour demand is falling, fiscal policy is tight, and the policy rate is well above our neutral estimate of 2-3%.Despite the recent weak news on activity and the uncertainty around the global outlook due to Trump’s US import tariffs, the stronger news on domestic price pressures means the Bank of England will probably continue to cut interest rates only gradually.But while CPI inflation may rebound from 2.5% in December last year to around 3.0% later this year, we think a fall to below 2.0% next year will prompt the Bank to cut interest rates from 4.75% now to 3.50% by early 2026, rather than to 3.75-4.00% as investors anticipate. Continue reading...

Rolling coverage of the latest economic and financial news

The $60bn merger between Nissan and Honda to create the world’s third-largest carmaker looks on the brink of collapse this morning.

According to reports from Japan, Nissan CEO Makoto Uchida met with Honda CEO Toshihiro Mibe today, and explained that he wishes to terminate their merger discussions.

Nissan’s board is in favour of abandoning merger talks with Honda, although calling them off has yet to be decided by executives at the two Japanese carmakers, a source close to the matter told AFP on Thursday.

“The latest conditions put on the table by Honda are unacceptable for Nissan... It needs to be formalised, but basically, it’s over,” the source said.

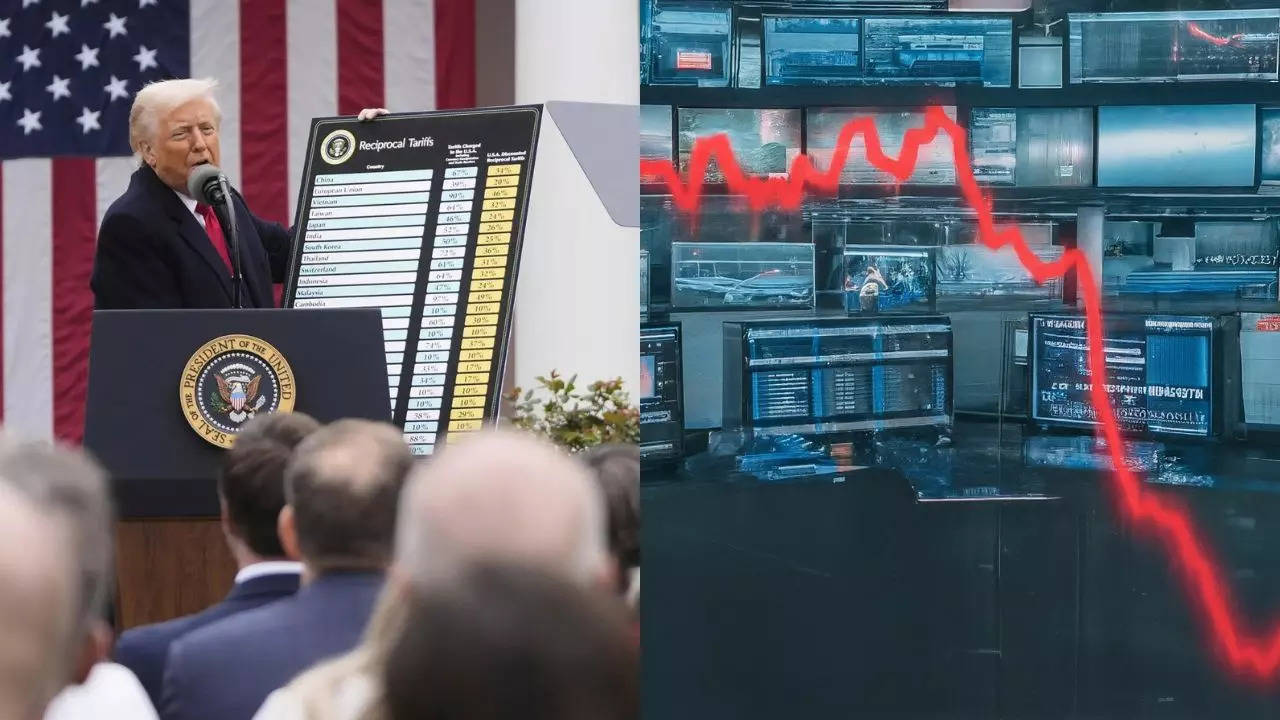

Looking ahead, we see room for deeper cuts than what financial markets expect. Trade uncertainty is rising, labour demand is falling, fiscal policy is tight, and the policy rate is well above our neutral estimate of 2-3%.

Despite the recent weak news on activity and the uncertainty around the global outlook due to Trump’s US import tariffs, the stronger news on domestic price pressures means the Bank of England will probably continue to cut interest rates only gradually.

But while CPI inflation may rebound from 2.5% in December last year to around 3.0% later this year, we think a fall to below 2.0% next year will prompt the Bank to cut interest rates from 4.75% now to 3.50% by early 2026, rather than to 3.75-4.00% as investors anticipate. Continue reading...

What's Your Reaction?