Higher employment costs and interest rates to push UK firms into financial trouble; Trump tariffs would ‘hit growth’ – business live

Rolling coverage of the latest economic and financial news

Analysts at Goldman Sachs have predicted that the increase in employers’ national insurance contributions will weigh on the economy in 2025.

In their outlook for the UK economy next year, just released, Goldman say they think growth is likely to cool later in 2025.

We expect consumer spending growth to moderate in H2 next year as real disposable income growth falls back. This partly reflects slowing real wage growth; we expect private sector pay increases to cool, partly because of the employer National Insurance Contributions increase being passed on to consumers.

Net interest is likely to become a headwind as effective mortgage rates continue to drift up while deposit rates gradually decline. And there is likely to be a continued drag on disposable income from the ongoing freeze on personal income tax thresholds.

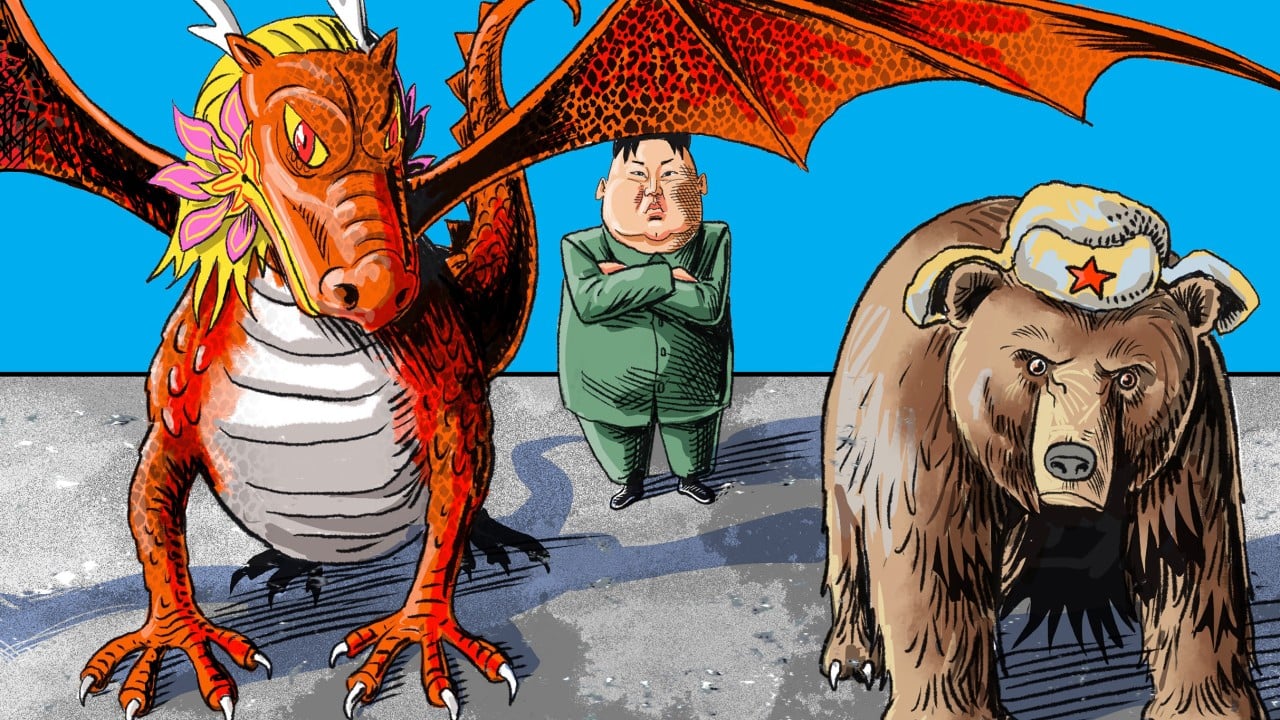

Although our base case is that the US only imposes very limited tariffs on the UK, the threat of more significant tariffs is likely to generate uncertainty in the near term, which should weigh on demand.

And we expect that uncertainty around tariffs will notably reduce Euro area growth, which is likely to generate spillovers to the UK. Continue reading...

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0