BlackRock taps Anchorage Digital for digital asset custody

Asset manager BlackRock is partnering with Anchorage Digital for crypto custody services, a move aimed at addressing the rising demand for digital assets from retail and institutional investors.

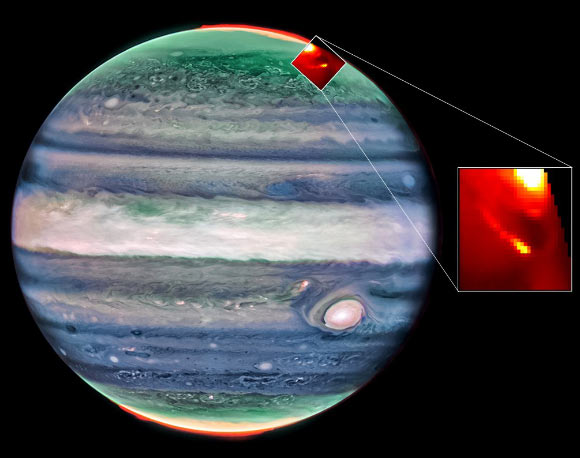

According to an April 8 announcement, BlackRock is the world’s largest investment firm, with $11.6 trillion in assets under management. The company ranks among the largest providers of crypto exchange-traded products (ETPs), with holdings totaling $45.3 billion in Bitcoin (BTC) and $1.7 billion in Ether (ETH), according to data from Arkham. BlackRock’s crypto holdings. Source: Arkham Intelligence

Anchorage is the only federally chartered crypto bank in the United States. Along with custody services, it will provide BlackRock access to digital assets staking and settlement. Anchorage currently supports BlackRock’s BUIDL fund — a $2 billion tokenized fund backed by US Treasurys and focused on real-world assets.

BlackRock relies on Coinbase for custody of the Bitcoin held in its iShares Bitcoin Trust ETF.

Related: BlackRock’s BUIDL fund explained: Why it matters for crypto and TradFi

Bitcoin ETFs have faced a turbulent path in 2025

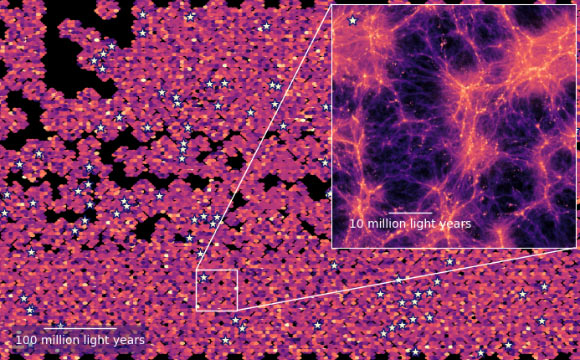

Since its debut in January 2024, Bitcoin funds have attracted a cumulative $36 billion in inflows. However, data from Sosovalue, which tracks ETF performance, shows that 2025 has been marked by sharp swings, with periods of strong inflows followed by significant outflows. Bitcoin ETFs daily inflow-outflows. Source: Sosovalue

Bitcoin funds are seen as some of the most successful ETF launches in history, with BlackRock’s iShares Bitcoin Trust ETF outperforming competitors and recording a net inflow of $39 billion, according to Sosovalue. The firm has since launched a crypto ETP in Europe.

Magazine: X Hall of Flame: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0