Bessent warns China on currency moves, says bond market 'deleveraging' isn't systemic issue

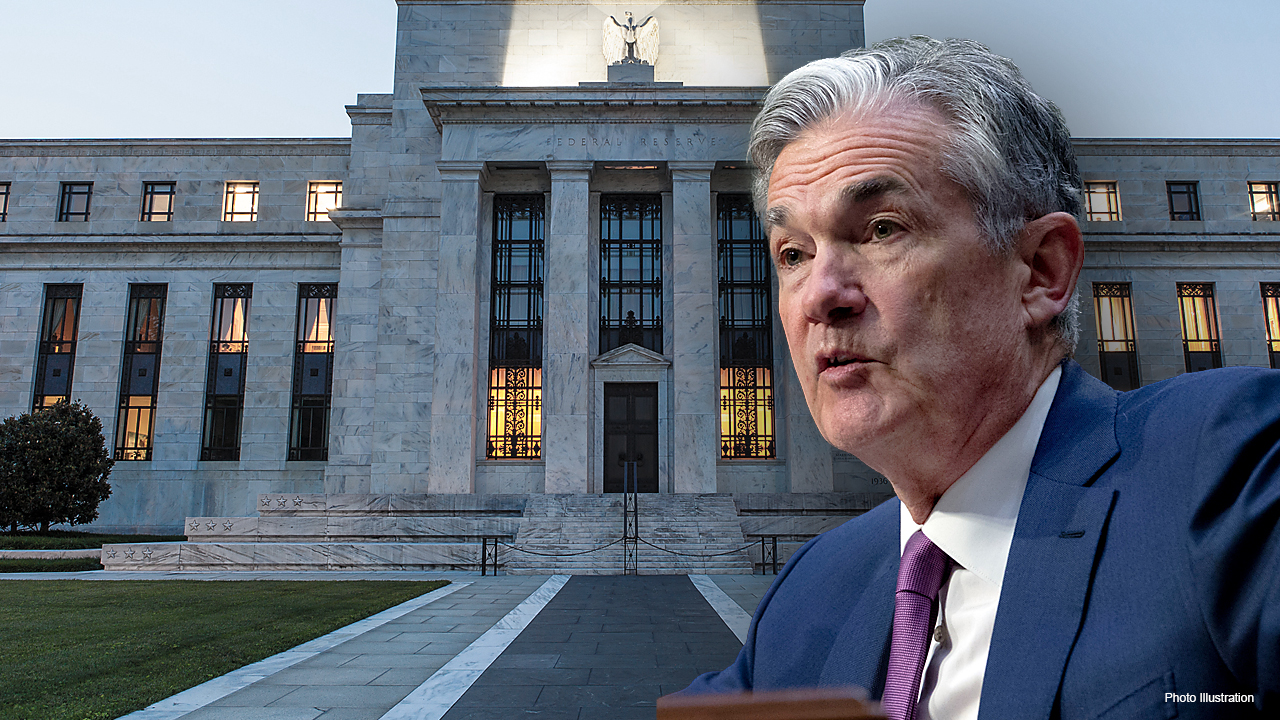

Treasury Secretary Scott Bessent said Wednesday that he doesn't see any systemic issues with the bond market amid deleveraging in the sector, and issued a warning to China that dumping U.S. Treasurys would cut against China's goal of a cheaper currency.

Bessent appeared on FOX Business Network's "Mornings with Maria" and told host Maria Bartiromo that what's happening with Treasury bonds appears to be normal deleveraging and that he expects that market concerns about that activity will subside as the process plays out.

"I've seen it very often in my market career – there's one of these deleveraging convulsions that's going on right now in the markets and I think it's in the fixed income market," he explained. "There are some very large leverage players who are experiencing losses that are having to deleverage."

"I believe that there is nothing systemic about this, I think that it is an uncomfortable but normal deleveraging that's going on in the bond market. And I expect that as we see the leverage come down, the risk managers tapping people on the shoulders, telling them to bring their books down, which is what happens every couple of years as leverage builds up, then the market will calm down," Bessent said.

SCOTT BESSENT BLASTS CHINA'S RETALIATORY TARIFF PLAY AS LOSING MOVE

Yields on the 10-year Treasury have been volatile in recent weeks amid the uncertainty over the Trump administration's tariff plans. It began March at about 4.2% and peaked at about 4.4% late last month, before declining to below 4% last Thursday and Friday following Trump's "Liberation Day" tariff announcement on April 2. This week, yields have surged and touched 4.5% on Tuesday and are now roughly 4.39% as of Wednesday morning.

Bartiromo asked Bessent if the bond markets are experiencing a deleveraging issue and whether China's government – which is the second-largest foreign holder of U.S. Treasurys – has begun dumping its bonds to put pressure on U.S. financial markets.

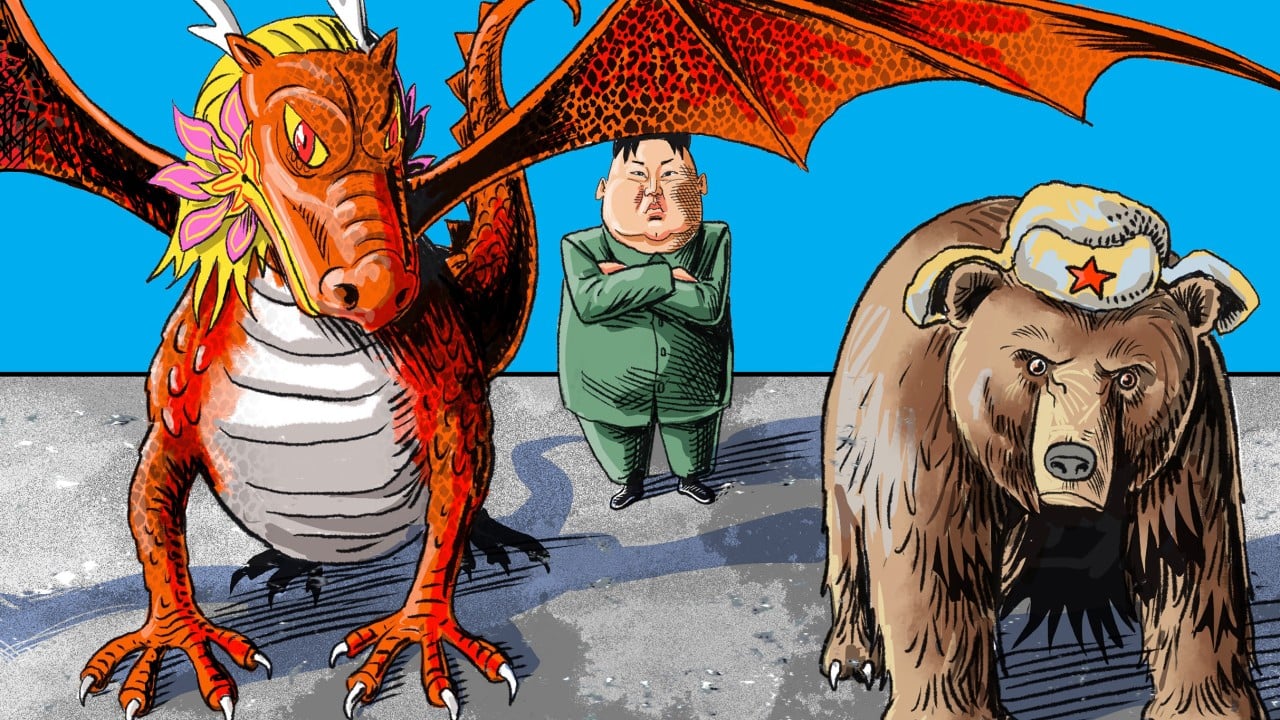

"You know, Maria, I think it works against their purposes if they are dumping Treasurys, because if they're dumping Treasurys, then they have to buy something else. If they sell dollars then they strengthen their currency, and as I said earlier, they've actually been weakening their currency, which is a loser for everyone," Bessent said.

CHINA TO INCREASE TARIFFS ON US IMPORTS FROM 34% TO 84%

The treasury secretary went on to say that China's efforts to drive down the relative value of its currency, the yuan, to support its large export market is a dynamic that he says would make the yuan ill-suited to replace the U.S. dollar as the world's reserve currency due to its unreliability.

"When I hear all these stories that the dollar is no longer going to be the reserve currency, if you end up with the Chinese who are willing to use their currency as a trade tool, then that doesn't seem like a very good reserve asset to me," Bessent said.

While the U.S. dollar has strengthened against China's yuan in recent weeks, it has weakened against other major currencies such as the Japanese yen and the European Union's common currency, the euro.

EUROPEAN UNION APPROVES RETALIATORY TARIFFS ON BILLIONS IN US IMPORTS

Bessent attributed those changes in the currency market to economic conditions and expectations in Europe and Japan. In particular, he noted that European NATO members are planning to ramp up defense spending to counter Russia and Japan has experienced economic growth, which has spurred higher inflation expectations and higher interest rates as a result.

"I want to reiterate, the U.S. has a strong dollar policy and part of it is the overall – some of the bilateral, the dollar vs the euro, the dollar vs the yen," he said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"The Europeans are going to spend more on defense, so we are seeing upgrades, finally, to European fiscal spending and it was President Trump's pressure on NATO, on the military alliance, to say 'pay your fair share' and that will bump their economy. In Japan, the yen has been strong, but that is the result of very strong Japanese economic growth, rising inflation expectations, so the Bank of Japan is raising rates, so all that's natural," Bessent explained.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0